An auto accident with an uninsured driver is, in itself, a stressful and complex experience that can affect not only your day but also your physical, emotional, and financial well-being. When the other driver involved is uninsured, the situation becomes even more difficult and worrisome. In these moments, it’s crucial to know what steps to take to adequately protect yourself and assert your rights with insurance companies and the law.

When you collide with an uninsured driver, you face significant financial risks: from costly repairs to rapidly mounting medical bills, to potential loss of income if you’re unable to work. There are also legal implications, as you’ll need to know how to proceed to avoid being left unprotected and what mechanisms are available to claim what you’re owed.

The good news is that with the right information and a timely response, you can handle the situation safely, minimize the financial impact, and avoid wasting time on cumbersome paperwork. In this article, you’ll learn the importance of being prepared for these types of accidents, the essential coverage you should have in your insurance policy, and practical and legal recommendations for action in the event of a crash. This way, you’ll be prepared to face any eventuality with knowledge and confidence.

Why should you be prepared for an auto accident with an uninsured driver?

You might think, “This won’t happen to me,” but the reality is harsh, and Florida is no exception: according to national data, nearly 1 in 8 drivers doesn’t have mandatory insurance. This means that the possibility of encountering someone who doesn’t have the financial support to cover damages exists and is more common than you might imagine.

If you’re involved in an auto accident with an uninsured driver, the direct consequence is that any repairs, medical expenses, or compensation may be your responsibility, unless you have adequate coverage. This not only affects your pocketbook but can also cause stress, uncertainty, and considerable loss of time. Furthermore, it’s not just material losses that are at stake: your health and that of your passengers may be at risk if you don’t know how to act or what coverage is required to cover your medical expenses.

On the other hand, understanding this problem allows you to anticipate and have an action plan, not only to protect your assets but also to avoid losing the rights you are entitled to if you ever face this situation. So, more than an accident, this is an opportunity to take control and know exactly what to do and who to contact when you crash into an uninsured driver.

Step-by-step guide to handling an auto accident with an uninsured driver

The key to preventing this experience from becoming a bigger problem lies in how you act immediately after the accident. Here’s a practical and simple guide so you know what to do from the very beginning:

Stay calm and secure the scene

Even if the scare is severe, it’s essential to calm down and act with a cool head. The most important thing is to make sure no one is hurt, and if anyone is injured, call 911 immediately so medical services can arrive.

Always call the police

Even if the collision seems minor, calling the police is essential to maintain an official record of the incident. This report will be the key to any subsequent claim or proceeding with the insurance company or in court, as it certifies what happened, where it happened, and who was involved.

Additionally, the police can help determine if the other driver has a valid license and insurance, or if not, provide written evidence.

Document everything in detail

Photographs and evidence are your best defense: take clear photos of the damage to both vehicles, the license plates, nearby traffic signs, and, if possible, the other driver’s face.

Also, write down as much information as possible about the other driver: full name, address, license number, and policy number (if provided). If there are witnesses, ask for their information so they can testify if necessary.

Also, save any medical records, receipts, or reports you generate from the accident.

Check the other driver’s insurance status

If the other driver refuses to provide their information, or if the police confirm they don’t have insurance, it’s essential that you report this to your insurance company to activate your uninsured motorist (UM) coverage.

This coverage is specifically designed to protect you when the at-fault driver doesn’t have insurance or flees the scene.

Notify your insurance company immediately.

Don’t wait; contact your insurance company as soon as possible. They will guide you through the next steps, review your policy, and explain how to activate the applicable coverages.

If you have uninsured motorist (UM) coverage, your insurance company will cover medical expenses and vehicle repairs, subject to the limits of your contract.

Consider a lawsuit

In some cases, if the uninsured driver has financial resources, a lawyer can help you sue for compensation for damages. However, this option isn’t always viable because these drivers often don’t have enough assets or income to cover the costs.

That’s why it’s important to consult with a specialist who can tell you if this option is worthwhile.

Seek legal advice and professional support

Many accidents become more complicated when insurance companies try to reduce the payout or when you don’t know who to turn to. Having the advice of an experienced traffic accident and insurance lawyer is a smart way to protect your rights and make the process smooth and transparent.

Professional support also prevents you from making mistakes that could harm you later, or helps you better handle a denial or disagreement with the insurance company.

Insurance coverage that protects you against an auto accident involving an uninsured driver

To live peacefully in Lakeland and other Florida cities, it’s essential that when purchasing your auto insurance policy, you make sure you have the coverage that truly protects you in the event of an accident with an uninsured driver. Although Florida law requires certain minimum coverages, these are often not enough to protect you from all the risks involved in colliding with someone who is uninsured or has insufficient insurance.

The reality is that Florida has one of the highest rates of uninsured drivers in the United States: nearly one in four vehicles is driving without the minimum required coverage. Therefore, although it’s not always mandatory to have additional protection, it’s highly recommended to prevent an auto accident with an uninsured driver from causing medical expenses, damage to your vehicle, and significant financial losses that you’ll have to bear without support.

Having adequate coverage means your insurer will be able to cover these expenses, at least within the agreed-upon limits, and you’ll be able to access benefits not covered by basic policies. These coverages also include protection in cases such as hit-and-run accidents, underinsured motorist coverage, and other scenarios where the other driver’s liability is not covered or is partially covered.

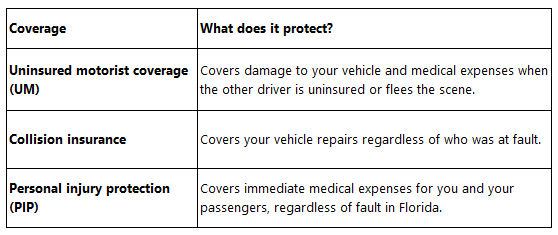

Below, we’ll explain some coverages to consider if you want to avoid costly surprises and have real support in the event of a car accident with an uninsured or underinsured driver.

Practical information to avoid surprises after the accident

After experiencing an auto accident, especially one involving an uninsured driver, it’s normal to feel overwhelmed and confused by the entire process that follows. Beyond the immediate first steps, there are a number of practical recommendations that can make a big difference so you aren’t caught off guard, avoid future problems, and properly manage your claim.

Read and Understand Your Policy in Detail

Many people sign their insurance policy without fully reviewing it or knowing the specific coverages it includes. For example, uninsured motorist (UM) coverage is not mandatory in Florida, and therefore, some drivers do not have it. This can turn an accident with an uninsured driver into a real problem if you don’t have the proper coverage. Take the time to carefully review your policy, ask your agent any questions, and make sure you know what protections you have.

Never sign agreements, waivers, or receipts without legal advice or your insurer’s approval

Sometimes, the other driver, their insurer, or even unauthorized individuals may pressure you to sign documents that seem simple, but that may actually mean waiving important rights or accepting compensation that doesn’t cover all your damages. Before signing any documents related to the accident, always consult with your insurer or seek legal advice to protect your interests.

Be polite and clear in your communication

Maintaining a cordial attitude and explaining the facts clearly and objectively will facilitate the work of both the police who prepare the reports and your insurance company. Avoiding confrontations or arguments that could complicate the situation will also help the process move more quickly and smoothly.

Don’t negotiate directly with the uninsured driver or accept informal arrangements

It may seem tempting to quickly resolve the issue “between you” to avoid paperwork or conflict. But accepting verbal agreements or informal payments puts your legal and financial security at risk, as in many cases the uninsured driver will be unable to fulfill their commitments, leaving you without support and without resources to repair damages or cover medical expenses.

Keep absolutely all related documentation

This includes clear and detailed photos of the vehicles, the accident scene, and any personal evidence; medical reports and bills for treatment or rehabilitation; police reports; as well as electronic or in-person reports filed with traffic authorities. Keeping this documentation will help you support claims, defend your rights before insurance companies and in the event of legal proceedings, and keep track of any pending proceedings.

Following these recommendations will not only protect you against potential problems or denials of your claim, but will also allow you to have a much clearer and more orderly path to overcoming the inconveniences caused by a car accident with an uninsured driver. The key is to remain calm, be well-informed, and have the right support at every stage of the process.

Frequently asked questions

Yes, but first, consult a lawyer to determine if the other driver has the ability to pay to make the claim worthwhile.

Report it to the police and use your UM coverage to have the insurance cover the damages.

In accidents where there is damage or injury, yes. The police report is crucial to validate any claim.

Final words

Facing an auto accident with an uninsured driver can turn a bad time into complete chaos, especially if you’re not prepared to handle the situation. Uncertainty, unexpected expenses, and legal proceedings can create an enormous burden if you don’t have the proper information and support. However, when you have the right information, react promptly, and have the right support, you can protect not only your health and safety, but also your wallet and legal rights, avoiding further complications and unnecessary stress.

Preparation is the key to facing any accident with confidence. This includes everything from ensuring you have the right coverage in your insurance policy to knowing exactly what to do from the moment the collision occurs. With this preparation, you reduce risks, streamline the process, and prevent an unfortunate incident from affecting your life longer than necessary.

In Florida, no one is immune to unexpected situations like an auto accident with an uninsured driver. Having reliable support and clear solutions makes all the difference in getting through these difficult times. At Veneville Insurance LLC, we know what this means for you and your family, and we work to offer you real protection and friendly advice, with the commitment to always support you along the way. Because your safety and peace of mind deserve to be well protected, today and tomorrow!

All our posts are referential

Our policies and their coverage are individual and personalized to each specific situation.

At Veneville Insurance, we’ll happily offer you multiple insurance options.

In Florida, it’s supposed to be mandatory to have a minimum amount of auto insurance, but I had a crash with a driver who did’nt have insurance. I knew what to do, but it’s very unpleasant. Thanks Veneville for helping me!