Have you ever wondered why auto insurance in Lakeland can cost so much, or why your premiums go up even if you haven’t changed your auto? The answer almost always lies in your driving record. This record is like your letter of introduction to insurance companies, and it can mean the difference between paying an affordable rate or an amount that makes you think twice before renewing your policy.

In Lakeland, where life on the roads can be as unpredictable as it is unpredictable, understanding how the insurance system works is key to protecting your wallet. It’s not just about avoiding tickets and accidents, but also about knowing how every detail of your history can directly impact the price you pay month after month. Furthermore, competition between insurers and changes in state regulations make staying informed more important than ever.

That’s why, in this article, I’m going to explain, as if we were just chatting with friends, why your driving record is so critical to insurers when calculating the cost of your auto insurance in Lakeland, what other factors come into play, and, above all, how you can improve your profile to pay less. If you want to save money and drive with peace of mind, here you’ll find clear answers and practical advice to take control of your auto insurance in Lakeland.

Why does a driving record have such a significant impact on auto insurance costs in Lakeland?

Insurance companies operate like any business that manages risk. By analyzing your driving record, they seek to predict the likelihood of you filing a claim in the future. If you have a clean record, with no accidents or violations, you’re an attractive customer because you’re less likely to cause a costly accident. Conversely, if you’ve accumulated tickets, collisions, or, worse yet, a DUI, the insurer assumes you’re more prone to trouble. This is especially relevant when looking for auto insurance in Lakeland, where companies evaluate these factors to offer you the best rate based on your profile.

In Lakeland, where traffic can be unpredictable and accidents are not uncommon, companies scrutinize your record. A single accident can increase your premium by up to 30% over several years, and if you have multiple incidents, you could end up paying double or more than someone with a clean record. Furthermore, insurers consider not only the severity of the incidents but also their frequency: several minor violations can be as significant as one serious accident.

What does your driving record include?

Your driving record is a detailed record that includes:

- Reported accidents, both at-fault and non-at-fault.

- Tickets for speeding, red light violations, cell phone use, among others.

- DUIs or driving under the influence of alcohol or drugs.

- Previous insurance claims, even if they weren’t your fault.

- License suspensions or revocations.

Each of these factors carries a different weight. For example, a DUI can affect your premium for up to 10 years, while a minor ticket could disappear from your record in three years if you don’t reoffend. Insurers also review whether you’ve taken defensive driving courses or shown improvement in your driving behavior, which can help reduce the impact of past incidents.

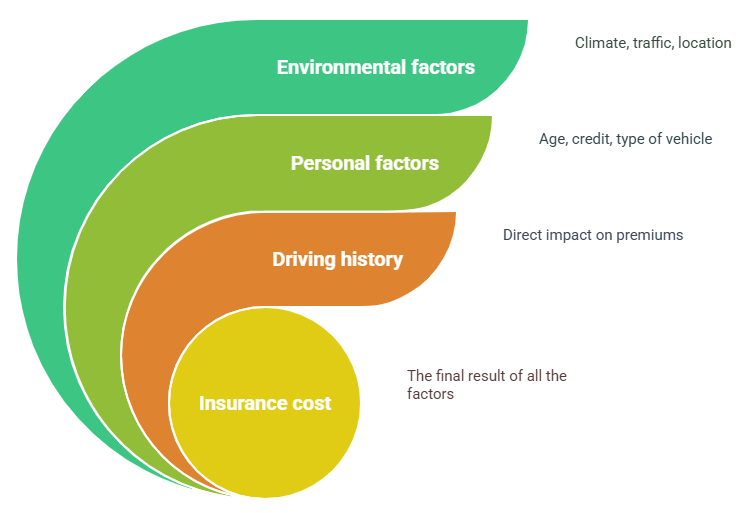

Other factors that influence the cost of auto insurance in Lakeland

Although your driving record is crucial, it’s not the only factor insurance companies consider when calculating your premium. Other factors can work for you or against you, depending on your situation and the environment in which you live.

Location and zip code

In Lakeland, your address can make a big difference in your insurance price. Areas with high rates of theft, vandalism, or accidents tend to have higher premiums because the risk of accidents is higher. If you live near the city center or in areas with heavy traffic, you could pay more than someone in a quiet residential area. Additionally, proximity to school zones, commercial areas, or highways also plays a role, as they increase the likelihood of incidents.

Age and gender

Young drivers, especially those under 25, and men tend to pay higher premiums because, statistically, they are involved in more accidents. However, as you gain experience and maintain a clean record, premiums tend to stabilize and can even drop significantly after age 30.

Credit history

In Florida, your credit score is a determining factor. A good credit history can lower your insurance costs by up to 30%, while poor credit can significantly increase your premium. Insurance companies believe that a financially responsible person will also be responsible behind the wheel, so taking care of your credit can have a positive impact on your insurance.

Vehicle type

The model, year, and features of your auto also influence the cost of your policy. Insuring a family sedan is not the same as insuring a luxury sports auto or a work truck. Autos with high repair costs, a higher risk of theft, or powerful engines tend to have higher premiums. On the other hand, if your vehicle has advanced safety systems, such as ABS brakes, airbags, and anti-theft devices, you can access significant discounts.

Use of the auto

The number of miles you drive each year is also relevant. If you use your auto only for grocery shopping or occasional errands, the risk is lower, and your premium may be lower. But if you drive to work every day, take long trips, or use your auto for business, the risk increases, and with it, the insurance cost.

Coverages and deductibles

The coverage you choose, and the deductible amount also affect the final price. If you opt for comprehensive coverage and low deductibles, your insurance will be more expensive, but you’ll have greater protection. If you can afford a higher deductible, your monthly payment will be lower, although you should be prepared to cover a larger amount in the event of an accident.

How to improve your profile and reduce your insurance costs?

Now that you know what factors influence your premium, here are some practical, proven, and simple tips to improve your profile and pay less:

Drive carefully

Avoid distractions, obey speed limits, and always be aware of your surroundings. A clean record is your best bargaining chip with insurance companies. Furthermore, driving responsibly not only helps you save money but also protects your life and the lives of others.

Keep your record clean

If you already have violations, it’s best to avoid repeat offenses. Over time, insurers value improvement and may lower your premium. Remember that patience and consistency are key: the longer you go without incidents, the more likely you are to get better rates.

Improve your credit

Pay your bills on time, reduce debt, and check your credit report regularly. A good credit score not only helps you get better terms on your Lakeland auto insurance but also in other aspects of your financial life. If your credit isn’t the best, start slowly; every improvement counts.

Choose a safe and affordable auto

Before buying a new auto, ask your insurer about the most affordable models to insure. Vehicles with a good safety reputation and low repair costs are typically cheaper to insure. Additionally, installing anti-theft or tracking devices can give you access to additional discounts.

Reduce your mileage

If you can, carpool, use public transportation, or work from home some days. Fewer miles per year means lower risk and therefore, a lower premium. Additionally, many insurers offer specific discounts for low-mileage drivers.

Increase your deductible

If you can save, consider raising your deductible. This lowers your monthly payment and, in the long run, can represent significant savings. Just be sure you have the deductible amount available in case you need it.

Take advantage of discounts

Always ask about available discounts: for good driving, for installing anti-theft devices, for paying the full policy, or for having multiple policies with the same insurer. Even small discounts can add up to a considerable difference at the end of the year.

Take defensive driving courses

Some insurers in Lakeland offer discounts if you complete a certified safe driving course. These courses not only help you save, but also improve your driving skills.

Review your policy every year

Don’t stay with the same policy out of inertia. Compare prices and coverage every year, especially if your credit history has improved or if you’ve made life changes, such as moving to a safer area or changing your auto insurance.

Specific factors in Lakeland you should consider

Lakeland has its own unique characteristics that influence insurance, and you should consider them when looking for the best policy for you.

Weather

Heavy rains, storms, and hurricanes can increase the risk of accidents and vehicle damage, which directly impacts premiums. Insurers adjust their rates based on the frequency and severity of these weather events.

Traffic

Rush hours, school zones, and commercial areas are often hotspots for minor accidents. Knowing the safest routes and avoiding peak congestion times can help reduce your risk of incidents.

Theft and Vandalism

Although Lakeland is not one of the most dangerous cities in Florida, some areas have more incidents of auto theft or vandalism. Installing alarms and tracking systems can help protect your vehicle and access discounts on your auto insurance.

Urban Growth

The development of new residential and commercial areas in Lakeland can change the risk profile of certain areas. Stay informed about changes in your neighborhood and check with your insurer if these changes affect your premium.

Frequently asked questions

Accidents typically remain on your record for 3 to 5 years. If you maintain a clean record after the incident, your premium may gradually decrease. Some insurers offer “accident forgiveness” programs that can help mitigate the impact if it’s your first incident.

You can’t erase them, but you can take driver’s education courses to reduce points and prevent them from impacting your premium as much. Additionally, over time and without repeat offenses, the impact of tickets diminishes until they disappear from your record.

Talk to your insurance agent. Sometimes changing coverage, increasing your deductible, or taking advantage of discounts can help balance costs. It’s also a good idea to compare options with other insurers to ensure you continue to get the best possible rate.

It depends on the policy. Some cover occasional drivers, while others only cover designated drivers. Check with your agent to find out exactly what coverage you have and if you need to make adjustments.

Yes, but you’ll likely pay higher premiums initially. However, some specialized companies may offer better deals if you demonstrate improvement in your driving record. Don’t be discouraged: with time and good habits, you can access better rates.

Final words

Your driving record is like your letter of introduction to insurance companies. A clean record opens the door to better rates and more options, but even if you’ve made mistakes, you can always improve your profile and save money. In Lakeland, where the average cost of insurance is competitive but sensitive to these factors, taking control of your record and your driving habits is the best strategy to protect your finances and your peace of mind.

Finally, it’s important to always stay informed about local regulations and the latest auto insurance news in Lakeland. The insurance market is constantly changing, with new policies, discounts, and technologies that can benefit you. Staying up to date allows you to make smart decisions and take advantage of every opportunity to improve your profile and reduce costs, making you a more conscious and prepared driver.

All our posts are referential

Our policies and their coverage are individual and personalized to each specific situation.

At Veneville Insurance, we’ll happily offer you multiple insurance options.